Reimann Investors invests in Predium as part of €13m Series A round

Reimann Investors participates in the Series A financing round of Munich-based SaaS company Predium, which is transforming the property industry with its Real Estate Intelligence platform.

Nov 28, 2024

The founders of Predium: Mohamed Ali Razouane, Maximilian Körner and Jens Thumm (from left to right)

Reimann Investors has participated in the Series A financing round of the Munich-based software company Predium. The round, in which Predium raised a total of 13 million euros, was led by Norrsken VC from Stockholm. Other investors include existing backers UVC Partners, b2venture and Mutschler Ventures.

The real estate industry is facing profound changes: ESG criteria have long been more than just a buzzword. They have become decisive factors that significantly influence the value of real estate. Real estate owners and managers are faced with the challenge of making their portfolios not only sustainable, but also economically future-proof. This is where Predium comes in: The company has developed an innovative real estate intelligence platform that meets these complex requirements.

Predium: a platform for sustainable and profitable properties

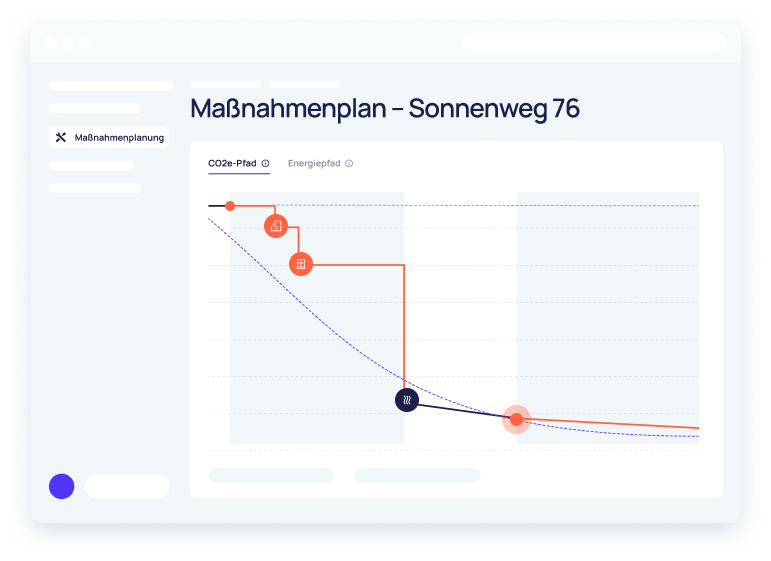

Founded in 2021 by Jens Thumm, Mohamed Ali Razouane and Maximilian Körner, the company uses artificial intelligence and 3D models to quickly and accurately analyse the ESG of buildings without the need for an on-site visit. The platform helps real estate owners and managers to efficiently identify ESG risks, develop decarbonisation strategies and plan investments in a cost-optimised manner.

The software is already being used by leading companies such as Colliers, Bayerische Hausbau, WBM and Deutsche Investment. These clients use the platform to future-proof their property portfolios, meet regulatory requirements and achieve sustainability goals.

Dr Hans-Christian Perle, Managing Director of Reimann Investors, comments:

"Predium has convinced us with its innovative real estate intelligence platform and a highly committed team. The extremely positive response from clients shows that Predium already offers decisive added value. We are convinced that the team led by Jens Thumm, Mohamed Ali Razouane and Maximilian Körner will have a lasting impact on the industry. We look forward to accompanying the company on its growth path and helping to shape the future of the property sector together with Predium."

Investment strategy: High-growth B2B SaaS companies

The investment in Predium is another example of Reimann Investors' investment strategy: to invest in fast-growing B2B SaaS companies from the DACH region that generate significant added value for the daily work of their customers. Predium combines technological innovation with the ability to efficiently address regulatory challenges and business requirements.

Further information

For more information about Predium and its role in the sustainable transformation of the property industry, please visit www.predium.de

© 2025 Reimann Investors